Loans for Start Up Businesses

The fastest and reliable way get your Startup Business finance.

What is Startup Capital Loans?

Are you ready to turn your business idea into a thriving reality? Securing the right funding is the first step in launching your dream, and at RiseFinex, we’re here to help you make it happen. Our Startup Business Funding solution is tailored for entrepreneurs like you—innovative, driven, and ready to make a difference.

With RiseFinex, you can access the capital you need without unnecessary delays or complications. Let us fuel your journey to success with fast, flexible, and hassle-free funding options designed for startups.

Benefits of a Startup Business Loans with RiseFinex

We understand the unique needs of startups and have designed our funding solutions to meet you where you are—whether you're in the planning stages or ready to scale.

How to Qualify for a Startup Funding

Qualifying for startup funding is straightforward and designed with accessibility in mind. We cater to businesses of all sizes and industries. Here’s what you’ll need:

No Minimum Time in Business

Whether you’re just starting out or have only recently launched, you can qualify for our premier financing options as a startup.

No Minimum Monthly Gross Sales

You can qualify for startup funding even if your business hasn’t generated monthly sales yet. Making it easier for new businesses to access the capital they need.

650+ Credit Score

To apply for startup funding, a minimum FICO score of 650 as the business not yet started. For MCA we accept all credit profile as they have a running business.

Why Choose Us For Start Up Funding?

At RiseFinex, our goal is to simplify business financing. We combine cutting-edge technology with personalized service to deliver a superior experience. Here’s why businesses trust us:

1. Fast and Flexible Loans

No one likes waiting, especially when it comes to launching a business. Our process is streamlined to get you funding fast—sometimes within 24 hours. Plus, we offer flexibility in loan amounts and repayment terms so you can choose what works best for your needs.

2. No Collateral? No Problem!

Many traditional lenders require collateral, making it hard for new businesses to qualify for funding. With RiseFinex, your vision and potential are what matter most. That’s why we don’t demand assets as security.

3. Expert Support Every Step of the Way

We believe in building partnerships, not just providing loans. Our team of funding specialists is here to guide you, answer your questions, and offer advice tailored to your unique situation.

Simple 3 Steps To Get Approval Today

Our AI-Powered Technology make it faster and even easier to asses and get fund easily.

Key Features Of Business Start Up Funding

At RiseFinex, our goal is to simplify business financing. We combine cutting-edge technology with personalized service to deliver a superior experience. Here’s why businesses trust us:

The RiseFinex Advantage

As a leading financial partner, RiseFinex is committed to supporting businesses at every stage of their journey. Whether you’re looking to scale operations, manage cash flow, or prepare for unexpected expenses, our business line of credit is a smart and flexible financing option.

Key Features at a Glance:

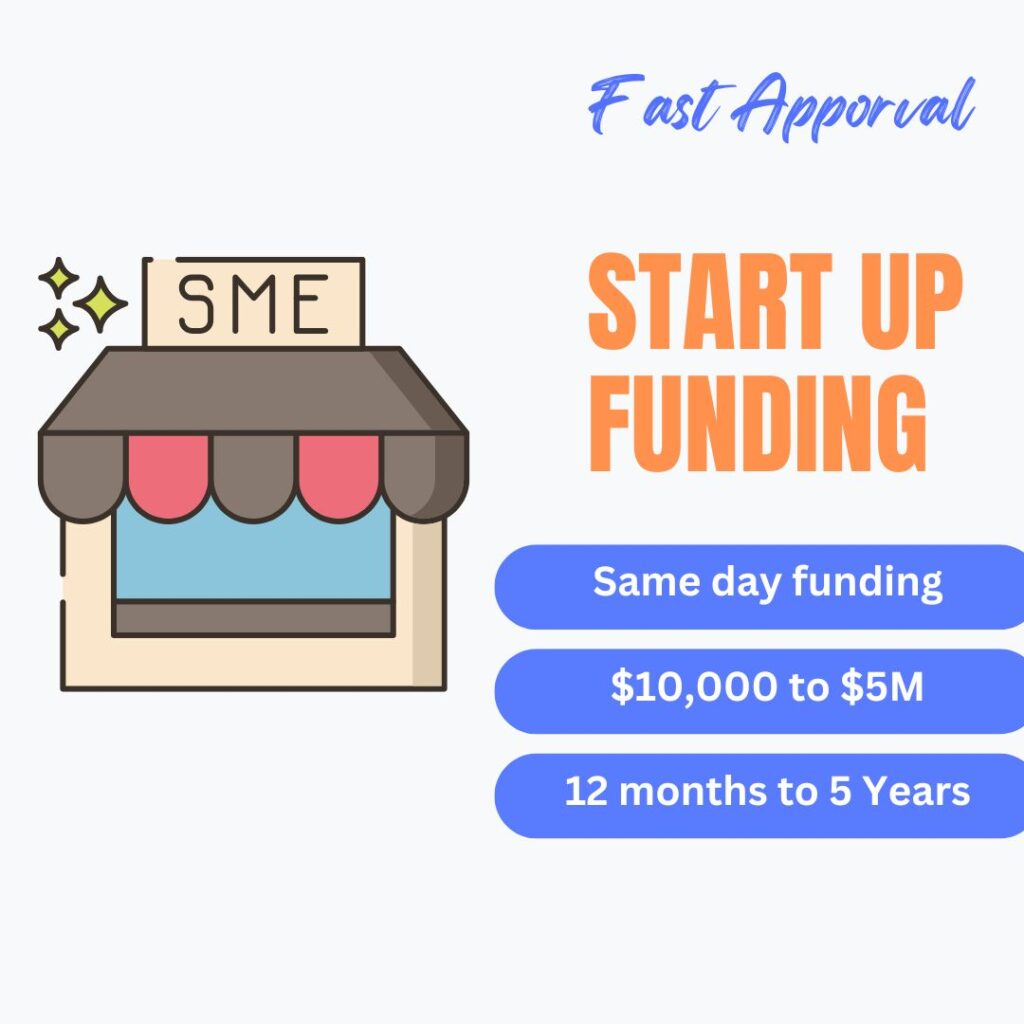

- Loan amounts: $10,000 to $5 million

- Terms: 6 months to 10 years

- Same-day funding availability

- Interest charged only on borrowed amounts

Startup Funding For Small Businesses

Startup funding for small businesses is the best decision you’ll make. With the right financing, you can:

- Purchase Equipment and Supplies

Get the tools and resources you need to hit the ground running. Here, our loan service for Equipment Financing

- Hire and Train Employees

Build a skilled team to drive your business forward.

- Launch Marketing Campaigns

Increase your visibility and attract customers with professional marketing.

- Secure Your Space

Cover the costs of a physical or virtual office, warehouse, or storefront.

- Build Cash Flow Stability

Manage operational expenses while your revenue grows.

Startup business funding may not be the best fit for you, especially if you’ve been running a successful business for a few years. Instead, you might benefit from other loan products tailored to established businesses. Explore all our business loan options here.

Are YOU Action Taker? Take 15 Seconds

Applying No Impact on Credit. Just Fill out the form You will know how much you qualify today! Our team will help you all the way to get easy term start up funding today!

©RiseFinex | 2025 All Rights Reserved